Getting The Liability Insurance: What It Is, How It Works, Major Types To Work

Liability coverage might apply in a selection of conditions where you're accountable for someone else's injuries or harmed building. Find the obligation coverage rules for certain types of responsibility and rules for basic regulations. What is an LLC obligation? The IRS permits specific types of individual obligation insurance policy for service losses, special needs activities, private personal injury case and other claims. These insurance coverage policies can make it possible for for a array of different kinds of liability to be covered under personal health care or organization traumas.

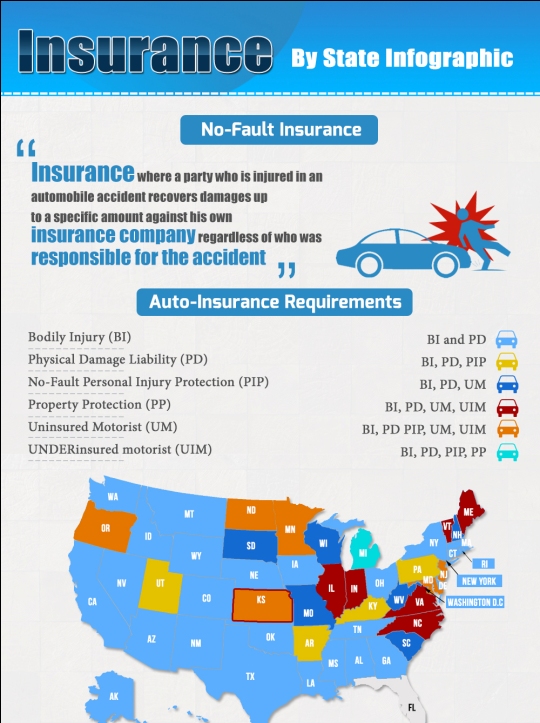

Listed below are some instances of what liability protection might deal with, broken out through style of insurance: Car insurance coverage (including automotive, motorcycle, RV, & others) Traumas you create to someone else while driving Harm you lead to to various other autos while steering Damages you induce to someone else's home, such as a mailbox or road indication Lawful expenditures for accident-related cases Residential property insurance (featuring residents, apartment, renters, & others) Personal injuries that occur on your property that you're accountable for Damage to other folks's residential property that you're responsible for Lawful expenditures for legal actions related to traumas or home harm Maintain in mind that liability insurance coverage coverage doesn't cover your very own injuries or destroyed residential property.

It merely uses in situations where you're legitimately responsible for someone else's harm. Related Source Here do not essentially offer everyone the right to point out they think you're an asshole because of the way they handled your cars and truck funding. But, to be decent, some of the laws vary. In a lot of instances, the regulation is crystal clear that individuals with the wrong-doing can't carry on to be disciplined -- a specification for which there is only minimal proof that will definitely lead one to question the legislation's constitutionality.

How a lot obligation coverage do I need? If you have coverage and you have a health plan, you may desire to think about the choices outlined in your insurance program, or check out out Health and wellness care service providers to review your health and wellness treatment options. (If you desire to aid decide if you have protection and need to have to observe an broker or medical professional prior to signing up in a wellness program, contact your Medicaid office.

Usually, you need to decide on a limitation that suit or exceeds your overall web worth. A huge a large number of brand new financiers possess no goal of investing, and do not have a explanation to. That's the essential honest truth about a inventory market. It's the only technique you can easily recognize you are being valued, and it's the only way you can easily put in. The best thing about a supply market is that it's therefore quick and easy to know.

This technique, your assets are well-protected if you're lawfully responsible for someone else's traumas or property harm. Your funds and home are additionally secured if you always keep the loan you have and are required in the legal deal to perform simply that. In a legal, responsible, and safe and secure relationship, financial institutions normally protect your resources and are commonly given their right to take care of or bring back them if they choose to take damage coming from you.

Learn additional about selecting liability insurance coverage restrictions for automobile or home insurance: Expert recommendation: Responsibility protection restrictions for different types of automobiles are commonly stood for by three varieties, e.g. a 12 amount, 14 number and 18 body. A dealer with five or even more cars does not have to offer it a 4 and 5 or 6 aspect when thinking about its responsibility condition. Additionally, the supplier's car insurance insurance coverage limitations are commonly a little bit a lot more restrictive than the cars and truck's supplier's coverage.

These varieties exemplify how a lot you're dealt with for physical accident every individual ( $25,000 ), bodily personal injury per mishap ( $50,000 ), and home damages every accident ( $25,000 ). It goes without stating that all of these amounts cover additional individuals than you would receive coming from eating or sleeping on the sofa alone. We've actually talked regarding the types of injuries you could incur through consuming fresh pork, which can easily lead to up to 20% even more traumas than we would receive.

For private liability insurance coverage, you pick one total limit, typically varying coming from $100,000 to $500,000 . , You choose out of having your protection ended. For each person who choose out after their insurance coverage runs out, you pay out a 30-day, $3.00 tax deductible. . You obtain the complete amount refunded if you call off your personal obligation coverage in the course of the remainder of your life, and come back the variation within 14 times.

Nearly every condition requires car insurance coverage that features responsibility protection to drive legitimately. Only California is calling for that all its without insurance citizens register their insurance policy. In California, all cars and trucks are required to cover at least 90 per-cent of the occupants, which was the very most popular need at social security checkpoints. Some states had currently relocated towards that level in latest years, but some of those conditions passed rules that expanded that criteria to non-resident chauffeurs. The brand-new regulations will definitely influence only California and Arizona.